Jordan Roy-Byrne – Price Action And Breadth Readings Of Gold Miners Is Constructive

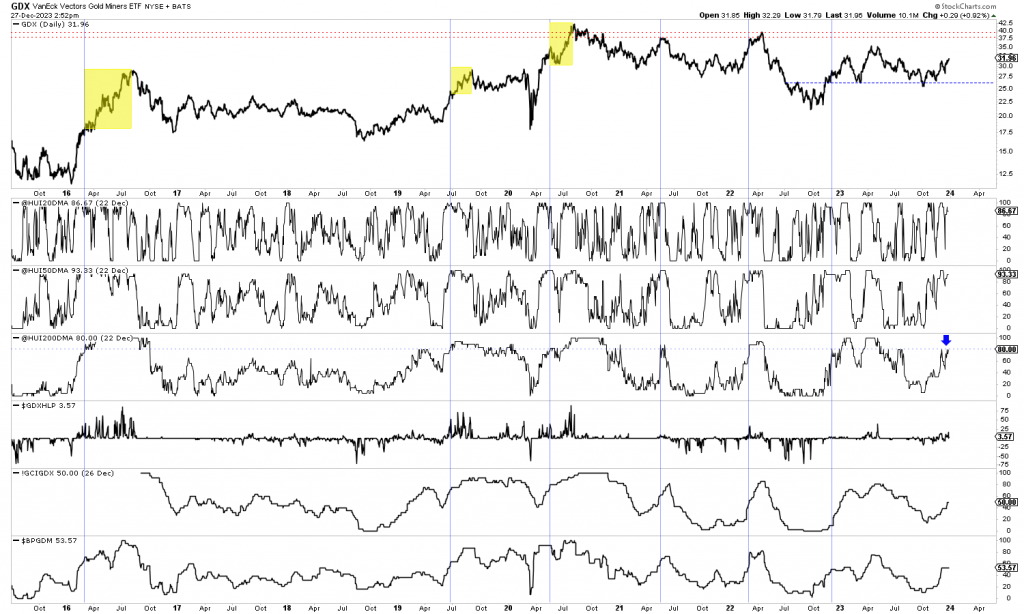

Jordan Roy-Byrne, Founder and Editor of The Daily Gold, joins us to review some of the technical reasons he’s constructive on a continued move higher for the gold mining stocks in 2024. We start off comparing how this recent move higher at year-end, differs from the one we saw the end of last year, in terms of where the gold price action is, but also in terms of the market breadth readings where the majority of the gold stocks included in the HUI have broken above their 200 day moving averages.

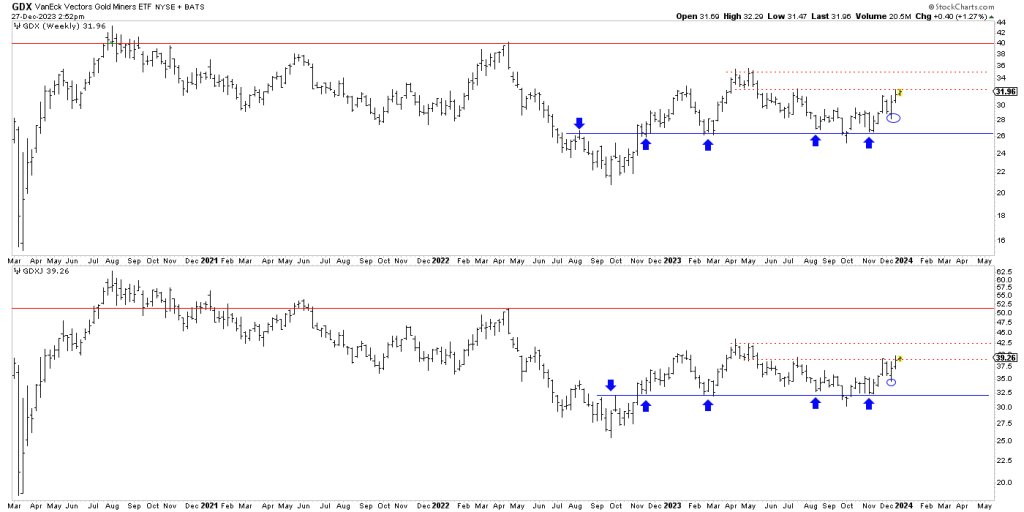

Next we got into some of the key technical levels Jordan has been watching in GDX and GDXJ, and why he feels the recent move out of the December lows over the last few weeks may still have some room to run to the upside; especially when combined with the positive market breath setup, and potential for the gold price to break out above $2100 and run significantly higher in the year to come.

.

Click here to visit The Daily Gold website and keep up to date on Jordan’s technical outlook.

.

.

.

.82 or bust…and bust

“The bubble that is exploding will be so ferocious that we will never see another bubble in our lifetimes.” Harry Dent

Come on, I know you guys like HD. LOL! DT

Hi Marc. This question was likely more suited to post on Christopher’s editorial than Jordan’s, as Christopher is very unlikely to come here to read your question on this totally different blog.

Really, it probably would be a better question to just send to him via email privately on his site, if you want to know more about the details; rather than you making a public assumption about it here and painting him as marketing to his “cronies” (which is not a complimentary light to shade things in). I’m sure you could just email him through iGold advisor directly.

Hi Marc. I’ve known Christopher for a number of years and always found him to consistently be a person of high integrity. Christopher is also a valued guest that comes onto our show to invest his time and knowledge with our audience, and we and many of our listeners absolutely appreciate him doing so. We do our best to screen out some of the more problematic characters in the investing arena, and bring on quality guests sharing good information, and with ethics and integrity in mind.

Personally, I’ve had many long conversations with him beyond just on investing, and he is a solid guy, that served his county in the military, has a big heart for his family, for his subscribers, and is genuinely trying to help people become more informed. Yes, he runs a business and needs to get paid for the service he provides, but he’s not some kind of lying newsletter shyster like you’re making them all out to be.

Therefore going straight to attacking a guest of our show’s credibility on a public forum, when you could have just emailed him FIRST to see if he would get back to you isn’t really good form and you know it. You don’t even know if he would have responded back, because you didn’t even make an attempt to do so.

Now, if he didn’t answer you, you could have also emailed myself or Cory and we could have sent your question over where he would have addressed it. You didn’t even try that avenue, and instead went straight to framing things in a negative manner publicly.

>> So yes, I think it could have been handled differently, but I still released your comments anyway (which went to moderation) , just so your voice could be heard (even though I was shaking my head when I did so).

Look, I have no idea if he got some of those finders fees for setting up buyers of the private placement, but even if he did there is nothing wrong about that, and really finders fees are a normal part of many financings for those that do all the legwork to line up the capital. Again, emailing him directly would have been the place to start asking if you wanted to know, or call the company directly and ask them which for their partners were awarded the finders fees.

You’ve gone after a few our guests on the show already like Dave Erfle and Byron King, and now Christopher Aaron, and all of those guys are solid human beings with integrity. We’ve lost quality guests on the show in the past because of people unduly heckling them from the forum, and while it is fine to be critical or have a dissenting opinion, it is usually not very professional to start attacking people’s integrity or character. Personally, I like a lot of your comments and resonate with a number of the points you make on companies or economics, but feel you’ve really ripped into a few of our guests lately a bit too aggressively.

Again, if you or anyone wants to ask our guests a specific question, that may be more appropriate directly instead of making a big stink on a public forum, then you can always submit a tactful question to Cory or I and we’ll pass it along. That doesn’t ensure it will get the full response back you want, but normally it will get a response. There have been some people in the past that sent over unhinged conspiracies or insanely insulting questions to forward along, which we aren’t going to do; but fair questions, even critical ones or ones were people are venting frustrations with decorum are fine and we will send those along.

Please just keep that in mind for moving forward with regards to guests or companies we bring on the show. We like the engagement from the audience, and appreciate all the interaction.

I’ll send Christopher over your question today, and then will email you back directly when he gets back to me.

Keep in mind the response may be a little slower as some folks are still traveling or visiting family or just checked out from the markets until the new year.

I just unpacked up above in another post why I came to Christopher’s defense, and you could have easily used the word “subscribers” or “friends” or “partners” instead of “cronies” which rarely has a positive connotation, and you know it.

We usually reserve the use of cronies for the central banksters and incestuous business deals between evil cabals. Getting a finders fee to broker a deal and raise capital is not unusual and well above-board on many financings or business transactions.

If I was a subscriber of his I would have taken part in the offer and couldn’t less if he collected a fee. His conflicts of interest, if any, have nothing to do with my opinion of the company.

Gold back up to $2095 in overseas trading. Let’s see if we can see the yellow metal break back up above $2100 here at the end of the week/month/year.

American Eagle Gold had a trade at 9:56:23 last evening at .244 USD when USD closed at 4:00 EST at .18. The CAD Close was .25. Let’s see how this works this AM. Those that illegal short should jump all over the USD OTC price at open. (This info is from Schwab, OTC Markets and Yahoo with CAD)

Bingo: USD American Eagle Opened at .1813 on Schwab. (Vs the late night .244 close). For those that did not catch the late entered close or the first trade, they will be confused about the -25% open and could panic and sell. Not counting the over .06 difference from the fake trade. How many stops were blown.

Can say whatever you want about inflation. Bottom line is all the essentials to live between food gas and home expenses( be it rent mortgage heat electricity water etc) are all up more and our weekly paycheque hasn’t kept pace for a few yrs now. What’s left for discretionary spending is half of what it used to be if you have any at all.

Just for clarity as you are newer here. I’m north of Toronto where Honda’s are built in Alliston and do home Reno’s in Toronto in the Forest Hill area so I’m more in tune with the Canadian economy and real estate

Gold & Silver Stocks Bullish in Q1 2024

By Jordan Roy-Byrne CMT, MFTA • December 27, 2023

https://thedailygold.com/gold-silver-stocks-bullish-in-q1-2024/

Hecla appears weak. $4.22 possible. More later.

Possibly due to firming rates and strengthening Dollar.

The USD might bounce at about 98.40 but I see little reason to expect that level to hold for more than a few weeks.

https://stockcharts.com/h-sc/ui?s=%24USD&p=M&yr=35&mn=11&dy=0&id=t1365425877c&a=1204820746&r=1703735039424&cmd=print